Risk management isn't some abstract corporate buzzword. It's the very real, practical skill of spotting, sizing up, and getting a handle on potential threats to protect whatever it is you're building—be it a business, a project, or your career.

It's not about trying to dodge every single risk out there. That's impossible. Instead, it’s about making smart, informed decisions that minimise the bad stuff and help you jump on opportunities when they pop up.

Think of it like this: you're the skipper of a boat. You wouldn't set sail without checking the weather forecast, charting your course, and knowing what to do if a storm hits. That's risk management in a nutshell. It's the simple, structured process of getting ready for the unexpected.

Rather than scrambling to put out fires after they've started, you're proactively building a framework to navigate choppy waters.

This way of thinking is vital for just about everything. A small business owner has to juggle financial risks like a sudden cash flow crunch with operational risks like a key piece of machinery breaking down. Our guide on how to start a small business digs into why this forward-thinking approach is so crucial from day one. And if you're after a really deep dive into the big-picture strategies, this comprehensive guide to Enterprise Risk Management in modern business is an excellent resource.

At its heart, the goal isn't to build an impenetrable fortress. It's about building resilience. You want to know that your organisation can keep its doors open, keep growing, and keep succeeding, even when things go sideways. This involves a constant cycle of planning, acting on those plans, and learning from what happens.

The objective of risk management is to ensure that an organisation makes optimal decisions under uncertainty. It's about enabling confident action by understanding the potential upsides and downsides of any choice.

This proactive mindset is critical on a national scale, too. Here in New Zealand, the government uses the National Risk Register to keep tabs on 33 distinct national risks that could affect the country's safety and well-being. This framework helps prioritise everything from natural disasters to cyber-attacks—an absolutely vital tool in a country where around 80% of Kiwis live near the coast, increasing our vulnerability to certain events.

No matter if you're managing a personal project or a massive corporate strategy, any solid risk management process rests on four key pillars. Think of these as the four main points on your compass for navigating uncertainty.

First, let's look at them in a quick table.

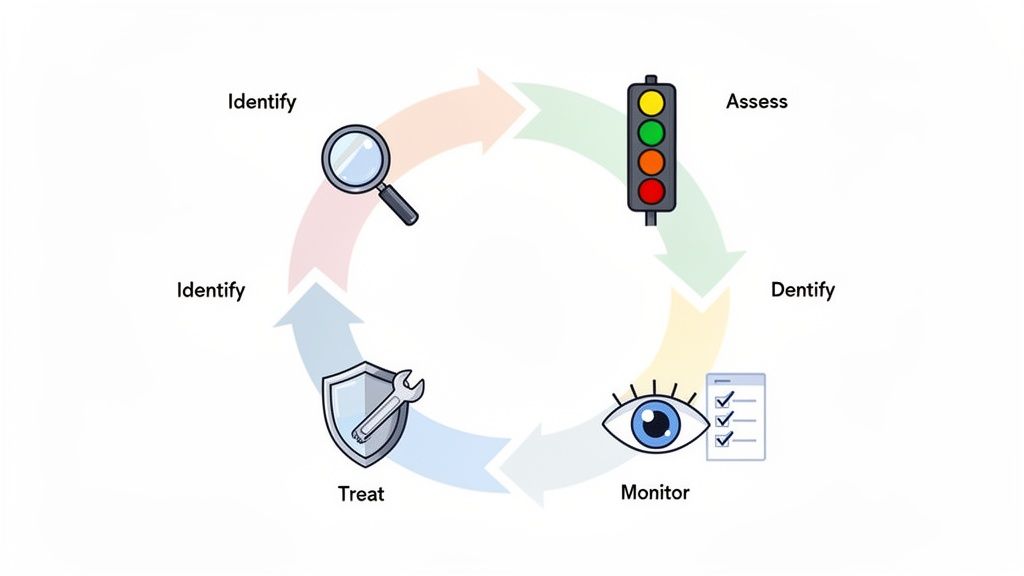

This cycle gives you a straightforward, repeatable way to handle whatever comes your way.

Effective risk management isn't some mystical art or a bunch of complicated formulas. It's actually a clear, repeatable cycle that anyone can learn and apply. Think of it as a practical playbook with four distinct stages, designed to move you from uncertainty to confident, proactive decision-making.

By breaking it down, you can tackle potential threats logically instead of getting swamped. This four-step loop—Identify, Assess, Treat, and Monitor—is the engine that powers all good risk management strategies, no matter the industry or scale.

First things first: you have to figure out what could go wrong. It sounds obvious, but you can't manage a risk you don't know exists. This stage is all about awareness and getting everything down on paper, creating a complete list of potential threats to your project, team, or organisation.

A fantastic way to start is by getting your team together for a brainstorming session. Everyone brings a different perspective to the table and can spot vulnerabilities others might miss. The goal here is to capture everything, no matter how small it seems.

The output of this step is your risk register. This is just a central log—often a simple spreadsheet—where you document every single risk you’ve identified. It becomes your go-to reference for everything that follows.

What could this look like? A construction company might identify risks such as:

Once you have your list, it's time to sort it out. Not all risks are created equal; some are minor annoyances, while others could be genuinely catastrophic. The assessment phase is where you analyse each risk to understand just how serious it is.

You do this by looking at two key factors for each risk: its likelihood (how probable is it that this will happen?) and its impact (how bad would it be if it did?). This is crucial for focusing your energy where it’s needed most.

A simple but incredibly powerful tool for this is the 'traffic light' system. It cuts through the complex maths and gives you a clear visual guide.

Now you know which risks need your attention, what are you going to do about them? This is the 'treatment' stage, where you pick a strategy to handle each significant risk. You generally have four main options to choose from.

Choosing a risk treatment strategy is about finding the right balance between the cost of managing the risk and the benefit you gain from reducing it. There's no one-size-fits-all answer; the best strategy depends entirely on the specific situation.

Here are the four core strategies, often called the '4 Ts' of risk treatment:

Finally, it’s vital to understand that risk management isn't a one-off task you can tick off a list. It's a continuous, living process. The world changes, new risks pop up, and old ones fade away, so your plans must adapt.

The 'Monitor and Review' stage makes sure your risk management framework stays relevant and effective. It involves regularly checking in on your risk register, seeing how well your treatment plans are working, and scanning the horizon for new threats.

This ongoing vigilance is what turns risk management from a static report into a dynamic process that builds real organisational resilience. It ensures you’re always prepared for what’s next, rather than just reacting to what’s already happened.

Once you’ve got a handle on the four-step risk process, the next piece of the puzzle is learning to spot the different kinds of threats that might be lurking. Risks aren't a one-size-fits-all problem; they come in all sorts of shapes and sizes, each one capable of affecting a different part of your business or career.

Think of it as moving from a vague sense of worry to a clear-headed analysis of where your biggest vulnerabilities lie. It's about putting names to the potential problems so you can tackle them head-on.

Every organisation, from a local chippy to a massive corporation, faces a set of well-understood risks. These are the classic challenges that have been shaping business strategy for decades, and they’re just as relevant today as they ever were.

At its core, identifying these risk types is about mapping out your entire operational landscape. It's asking, "What could go wrong with how we work, how we make money, how we plan for the future, and how we follow the rules?"

Answering those questions gives you a solid, 360-degree view of where you're most exposed. This methodical approach helps ensure no stone is left unturned as you start building out your defence plan.

Alongside these traditional concerns, a new breed of fast-moving threats is changing the game. These modern risks often slice across multiple categories and demand specialised attention because of their speed and potential for damage. They are a critical part of understanding what risk management truly means today.

Two of the biggest movers and shakers are cyber risks and the escalating impacts of climate change.

Cyber risks cover any threat to your digital world. This isn't just about shadowy hackers; it can be data breaches caused by a simple employee mistake, system failures, or cleverly disguised phishing scams. As more of our lives and businesses move online, the attack surface just keeps getting bigger, making cybersecurity a top priority for everyone.

Climate change risks, on the other hand, bring both physical and transitional threats. Physical risks include direct damage from extreme weather like floods or storms, which can halt operations and destroy property. Transitional risks pop up as we shift to a lower-carbon economy—things like new regulations or green technologies that could make your current way of doing business obsolete.

The mix of these modern threats is becoming incredibly complex. For instance, New Zealand's insurance sector is now scrambling to deal with artificial intelligence, which shot from the 10th biggest concern in 2023 to the #1 risk. It makes cyber crime (now #2) even worse by creating smarter attack methods.

At the same time, climate change has surged to the #3 spot. Events like Cyclone Gabrielle have thrown a harsh spotlight on the country's vulnerability to floods and erosion. The financial fallout has been staggering, with the house insurance price index soaring by 916% since 2000—the sharpest rise of any consumer item tracked by Stats NZ. You can dig deeper into these evolving threats in PwC's latest industry report.

To make this all a bit more concrete, let's look at how these different risks actually show up in some key New Zealand industries. What's a minor headache for one sector can be a complete showstopper for another.

Seeing these risks in action helps connect the dots between the theory and the real-world challenges you might face in your own career or business. It highlights why a tailored risk management plan, not a generic one, is so essential.

Understanding the theory is one thing, but seeing risk management work in the real world is where it all clicks. The principles of spotting, assessing, and treating risks aren’t just for corporate boardrooms; they’re used every day across a huge range of New Zealand industries to protect people, assets, and reputations.

Whether it’s ensuring patient safety in a busy hospital or preventing accidents on a construction site, the core process stays the same. The magic is in how it’s tailored to the specific challenges of each sector. Let's look at a few mini-case studies to see how different fields put these crucial skills into practice.

In healthcare, nothing is more important than clinical risk management. The main goal is simple: protect patients from preventable harm. A classic risk is a medication error—a patient getting the wrong drug or dosage—which can have devastating consequences.

Here's how a healthcare provider would tackle this:

For an IT company, a data breach is the stuff of nightmares. This is a major cyber risk. Losing sensitive client information can lead to massive financial penalties, destroy a hard-earned reputation, and completely erode customer trust.

An IT firm would manage this threat by:

On any construction site, health and safety risk is front and centre. A worker falling from a height is a significant risk that could lead to serious injury or death. The focus is always on creating a safe environment and stopping accidents before they happen.

The core of construction risk management is proactive prevention. It’s about building a safety-first culture where every person on site is empowered to identify and address hazards, turning the workplace from a reactive environment into a controlled one.

A construction firm's process would look like this:

A community services organisation works with vulnerable people, making reputational and safety risks absolutely paramount. A potential risk could be a breach of client confidentiality or an incident where a client is harmed due to inadequate supervision.

Managing this involves careful, compassionate planning:

Technology now plays a huge role across all sectors. For instance, exploring different property management apps for operational risk shows how digital tools can centralise tasks, streamline operations, and reduce human error.

Understanding risk management theory is a solid starting point. But the real value comes when you weave those ideas into your daily workflow, turning them into tangible strengths that boost your career.

You don’t need an official “risk manager” title to get going. Simply practising these skills on everyday tasks—whether at work or in your personal life—lays the groundwork for true expertise.

Effective risk management rests on a handful of transferable skills. Sharpening these gives you the confidence to plan ahead and make smarter decisions, whatever your industry.

You can start honing your risk management muscles this afternoon—no new job title required.

Begin with a small project you’re working on. Spend 15 minutes running through the four-step cycle:

Hands-on practice is where theory truly morphs into skill. Try applying this process to something like saving for a home deposit—you’ll spot financial risks (unexpected bills), measure their impact, and build a backup fund to stay on track.

If you’re ready to formalise your know-how or pivot into a new field, online courses let you upskill around your own timetable. They’re a smart way to add recognised frameworks and skills to your toolbox.

Fields such as business, IT and project management weave risk management throughout their curriculum. In fact, managing a project is really about keeping timelines, budgets and outcomes on course. Our guide on how to become a project manager dives into how these two disciplines intersect.

By choosing targeted online learning, you’ll gain practical approaches and employer-valued skills—transforming your grasp of risk into a genuine career asset.

Working through the fundamentals of risk management really just boils down to a powerful shift in mindset. It’s not about the impossible goal of wiping every single threat off the map. It’s about building the confidence and the frameworks to face uncertainty head-on, turning potential chaos into managed outcomes.

When you master the four-step process—identify, assess, treat, and monitor—you gain a tangible sense of control over what’s coming down the line. This proactive approach isn't just for one industry; it's a universal skill that applies to everything from personal projects and career growth to massive business strategies. It’s the difference between being a passenger along for the ride and the pilot at the controls.

This knowledge is your call to action. The real message here is one of empowerment, encouraging you to move from simply reacting to problems to actively anticipating them. That skill sits at the very core of strong leadership and sharp strategic thinking.

Embracing risk management means you stop firefighting and start architecting your success. You build resilience by preparing for what might go wrong, which frees you up to focus on what can go right.

This kind of forward-thinking is also fundamental when you're mapping out your future. A solid risk assessment, for example, is a non-negotiable part of the process when you decide to learn more about how to write a business plan, making sure your new venture is built on solid ground from day one.

By turning your understanding of what is risk management into a practical, everyday skill, you're positioning yourself for success. In a world that’s always changing, the ability to anticipate and prepare isn’t just an advantage—it's essential for navigating whatever comes next with clarity and purpose.

To wrap things up, let's tackle a few common questions that pop up when people start learning about risk management. These quick answers should help solidify some of the key ideas we’ve covered and give you some practical takeaways.

This is a great question, and it’s one that often trips people up. But the distinction is actually quite simple—and it’s at the very heart of proactive planning.

A risk is a problem that might happen. It’s a future possibility you can see on the horizon and prepare for. For example, a key supplier might miss a delivery deadline, which could throw your project timeline off track.

An issue, on the other hand, is a problem that’s happening right now. The supplier has missed the deadline, and you're now in damage control mode. The whole point of good risk management is to identify those potential risks so you can stop them from turning into full-blown issues.

You don't need a fancy title to think about what could go wrong. Risk management principles are incredibly valuable, transferable skills for absolutely everyone, no matter your role. At its core, it’s just about being proactive instead of reactive.

You can start applying this mindset in all sorts of everyday situations:

Thinking this way helps you take ownership and build resilience—two qualities that are highly valued anywhere you go. It shows you’re someone who anticipates challenges and has a plan ready to go.

A risk register sounds a bit corporate and complicated, but it’s really just a simple log for keeping track of potential risks. And no, it’s not hard to create at all. In fact, it’s one of the most powerful and easy-to-use tools in risk management. Most of the time, it's just a basic spreadsheet.

A risk register is what turns those vague worries floating around in your head into a structured, actionable plan. It takes you from "what if?" to "what's next?" by getting potential problems—and their solutions—down in black and white.

To get a basic one started, you only need a few columns:

This simple framework gives you a bird's-eye view of your vulnerabilities and what you’re doing about them. It's an essential tool for anyone wanting to bring a bit more structure to their projects and responsibilities.

Ready to build the skills that help you anticipate challenges and lead with confidence? Get Course New Zealand offers a wide range of flexible online courses in business, project management, and IT designed to fit your busy schedule. Explore our courses and take the next step in your career journey today at https://getcourse.co.nz.